COVID-19, as we all know, has been rather disruptive in 2020. First, the pandemic itself is creating havoc as a global health crisis. Second, government-ordered lockdowns, shutdowns and travel bans adds another layer of economic, political and social pain. Nobody yet knows just how much economic loss and damage the pandemic will ultimately cause, but it seems safe to assume this will be a very large number. All of which points to a frenzy of litigation as the lawyers argue about who should ultimately bear the cost.

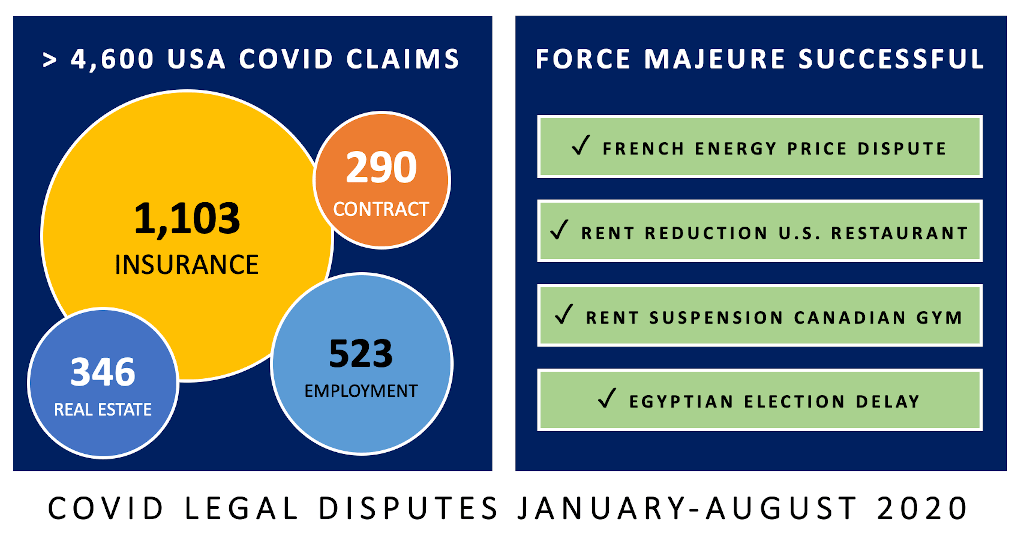

Force majeure has been a hot topic for contracts lawyers since the pandemic began. So I was curious to see how many court rulings have addressed the question whether the pandemic itself, and the government actions that followed, should be considered force majeure events that excuse contract suspension or termination. Cases in Canada and the U.S. have ruled that force majeure does excuse non-payment of rent, at least to some extent. A French court ruled that force majeure automatically suspended an energy supply agreement when the pandemic triggered a collapse in prices. And an Egyptian court ruled that the pandemic was a valid reason for delaying an election.

These decisions provide a few clues about how the humble force majeure clause will be interpreted over the years to come. But given the wildly variable nature of these clauses, you’ll need to do some careful analysis of the specific language lurking in your contract portfolio before drawing too many conclusions about how they protect or expose you.

According to this nifty COVID complaint tracker published by Hunton Andrews Kurth, there are probably many years of dispute ahead of us. As of August 2020 there are more than 4,600 COVID claims in the U.S. court system, including 1,103 insurance-related claims, 523 employment-related claims, 346 real estate claims and 290 contract disputes.

Of the 290 contract disputes, it appears that a majority have at least a force majeure element to them. Hot topics include (a) failure to provide a refund, (b) failure to close a deal (plenty of real estate examples), and (c) disputed termination (plenty of energy examples).

The large number of insurance (<1,000) and employment (>500) claims is to be expected. Many businesses will be discovering the devil in the details of insurance coverage and exclusions (who expected business interruption to last so long?). And with U.S. unemployment still above 8% in August, and the number of permanent job losers above 3 million, it’s not surprising that 277 unfair dismissal claims account for more than half the number of employment disputes.